What makes you creditworthy or not?

This is an interesting question - what makes someone creditworthy?

Well, technically someone is creditworthy as soon as someone else says that they are willing to give them credit - but that's probably too simple an answer to quite a complex question.

We do not believe in the view that if someone's had problems in the past, it automatically follows that are a bad person who deserves to be completely excluded from all financial products.

There are thousands of people that have had trouble in the past who we believe deserve a second chance.

Our approach is new and unique, so we wanted to take this opportunity to explain our product, how it works and who it is for.

All loan companies and banks go through a process of deciding if they want to lend money to someone. The method they use looks at past credit data to make predictions about how people will behave in the future. Specifically, they say if you have had problems in the past, then you are a bad customer who should not be trusted in the future.

We think that in a lot of cases this probably works well. But we also think this approach excludes thousands of people who may have had trouble in the past, but are now in a much better position and are fully able to manage their money and make their repayments.

Of course, there are many people who should not be borrowing at all because they are not in a position to manage a loan. So the question is how do we identify customers who should be able to borrow from those that shouldn't.

So how does our approach differ? Well, we consider this a question of "Is this person creditworthy?" and we think there are two different parts to that.

- 1. Is this person capable of paying back?

- 2. Can we trust this person to pay us back?

Both points are important. There are lots of trustworthy people who can't afford to pay back and there are lots of people who can afford pay back who are not trustworthy enough to do so.

For question number one, we work with the borrower to complete a budget plan. We look at their income, bills, credit commitments and other outgoings. This helps us understand if the borrower is capable of meeting the responsibilities that go with repaying a Transform Credit loan and if they can comfortably afford the monthly repayments while maintaining their current commitments.

To answer question two, we use cosigners. Cosigners have been used across the world for hundreds of years as a way of telling if someone is trustworthy or not - it's by no means a new idea.

The way it works is quite simple. A cosigner is a friend or family member who knows the borrower well, understands what happened in the past and the situation the borrower is now in. They are so confident that the borrower will make the repayments that they agree to step in if for any reason the borrower is unable to keep up.

Every cosigner goes through an assessment process and a review to make sure they fully understand and are happy with their responsibilities as a cosigner.

We believe this works much better than a computerized decision. Afterall, it's our friends and family that know us best, we let those people decide, not a computer system.

So let's recap what we've got so far.

Having some past trouble should not mean you are always excluded from Financial products.

People deserve a second chance.

Cosigners are a better tool to judge if someone is creditworthy than computer credit data.

Still with us? Great! So who exactly can be a Transform Credit Customer?

Based on some quick online searches we can see that all types of people have had some type of trouble in the past, it can happen to anyone, for any number of reasons - even politicians.

Sometimes things outside of our control lead to problems, This doesn't stop you from being a good person and it doesn't mean you can't or shouldn't be trusted.

Transform Credit's customers come in many different shapes and sizes. What brings all our customers together though is that they are trusted by their friends and family.

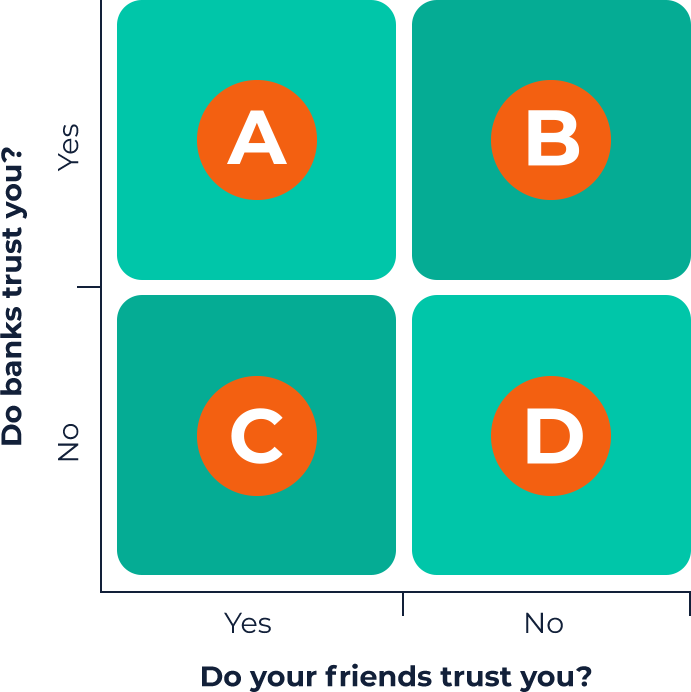

We believe everyone falls into one of these 4 boxes:

If you are in box A you can borrow from a bank and you will repay. You don't need Transform Credit - in fact, you're likely to think we're a bit expensive.

If you're in a box B you can borrow from a bank, but we don't think you should be able to. Box B is the reason the credit crunch happened.

If you're in box C then Transform Credit is for you. You've been let down by your current system and we're here to help you

If you're in a box D you can't borrow from a bank - or from Transform Credit. In fact, you shouldn't borrow from anyone right now - your friends are telling you something. They know you best and borrowing is almost certainly not good idea for you at the moment.

As a responsible lending business, we take a long term view of consumer finance. We do not offer loans for short term . Our loans are payable over terms up to 5 years and most customers choose a 3 year repayment period that allows them to manage their money in a controlled way.

So what makes you creditworthy? Well, if you are capable and able to pay back a loan AND you are trustworthy enough to do it - then you sound pretty creditworthy to us!